-

Interim Budget-2025

The Indian Budget 2025, presented by Finance Minister Nirmala Sitharaman on February 1, 2025, introduces several key initiatives across various sectors aimed at stimulating economic growth, enhancing infrastructure, and providing tax relief. Here’s a concise overview of the major announcements: 1. Taxation Reforms 🏦 2. Agriculture and Rural Development 🌾 3. Infrastructure and Urban Development…

-

LEI Number

The Legal Entity Identifier (LEI), a 20-character alpha-numeric code created by the International Organization for Standardization, is based on the ISO 17442 standard (ISO). The benefits of LEI Number is that it connects to crucial reference data, making it possible to clearly and specifically identify the legal entities taking part in financial transactions. Each LEI answers…

-

Import Export Code (IEC Code)

An Importer Exporter Code (IEC) is crucial business identification number which mandatory for export from India or Import to India. Unless specifically exempted, any person shall make no export or import without obtaining an IEC. For services exports, however, IEC shall not be necessary except when the service provider is taking benefits under the Foreign Trade…

-

Startup India Registration Scheme

Facebook Twitter Instagram Whatsapp

-

Annual Compliances for Private Limited Company

What are compliances to be maintained by the Private Limited Company? Annual ROC Filings Annual General Meeting Board Meeting Directors Report Facebook Twitter Instagram Whatsapp

-

MSME Registration

MSME means MIRCO, SMALL & MEDIUM ENTERPRISE CLASSIFICATION OF MSME Benefits of MSME registration ↗

-

Project Report

A project report is a document that describes a project’s objectives, milestones, challenges, and progress. It plays a critical role in the project planning and management process. Let’s take a closer look at project reports – meaning, types, components, and how to create one successfully. What is a Project Report? A project report is a…

-

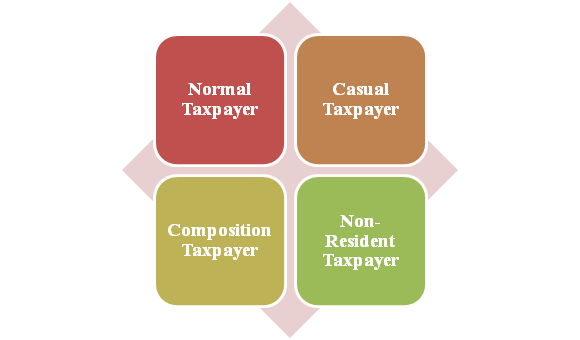

Types of GST Registration ??

Normal taxpayers : Most businesses in india fall under this category. Businesses whose turnover exceeds Rs. 40 lakh in a financial year are required to register as normal taxable people. However, the threshold limit is Rs. 10 lakh if you have a business in the north-eastern states, j&k, himachal pradesh, and uttarakhand. Casual Taxable Individual…

-

Goods and Service Tax

What is GST Registration ??? Objectives Of GST Who should Register for GST ???? Types of GST Registration ????

-

Income Tax Compliance

Click here for Filling of your Income Tax Return Filing income tax returns is often seen as a cumbersome process by the majority of the people. That is the reason why many decide to skip filing returns. As a responsible citizen, you need to make sure that you file your returns every year. This is…