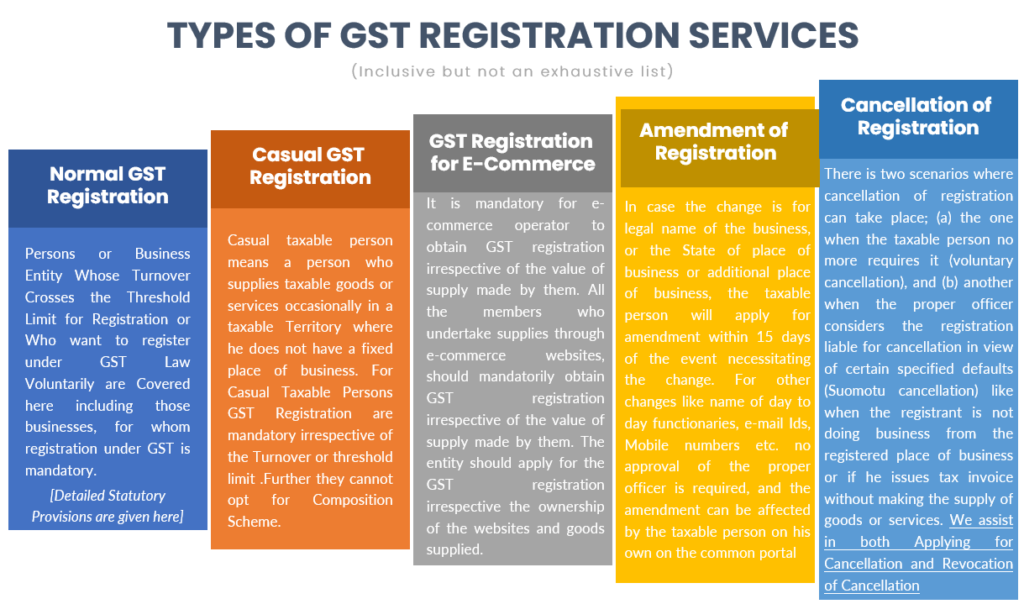

Normal taxpayers :

- Most businesses in india fall under this category.

- Businesses whose turnover exceeds Rs. 40 lakh in a financial year are required to register as normal taxable people. However, the threshold limit is Rs. 10 lakh if you have a business in the north-eastern states, j&k, himachal pradesh, and uttarakhand.

Casual Taxable Individual :

- Occasional or seasonal businesses need to register their businesses under gst for this category. Businesses need to make a deposit equal to the gst liability from the occasional operations.

- The tenure for registration is 3 months. However, businesses can apply for renewal and extensions.

Non-Resident Taxable Individual :

- Individuals who reside outside India but occasionally supply goods or services as agents, principals, or in other capacities to Indian residents are liable to file for registration under this category.

- The business owner must pay a deposit equal to the expected GST liability during the GST active tenure. The normal tenure is 3 months. However, individuals can extend or renew the registration if required.

Composition Registration :

- Businesses with an annual turnover of up to Rs. 1 crore are eligible for registration under composition scheme. Under this scheme, businesses have to pay a fixed amount of GST irrespective of their actual turnover.